Best business accounting app for business.

QuickBooks Online: A Comprehensive Accounting Solution

QuickBooks Online stands out as the best business accounting app, offering a suite of tools to meet the diverse needs of businesses, from freelancers and small enterprises to larger corporations. Here’s why QuickBooks Online is a top choice for businesses:

User-Friendly Interface

QuickBooks Online, an accounting app provides an extensive array of reporting features that empower users to create diverse financial reports, such as profit and loss statements, balance sheets, and cash flow statements. The dashboard provides a quick overview of key financial metrics, making it easy for users to understand their business’s financial health at a glance.

Cloud-Based Accessibility

As a cloud-based platform, QuickBooks Online enables users to conveniently retrieve their financial information at any time, from any location, and using any device connected to the internet. This adaptability proves especially advantageous for businesses with dispersed teams or individuals requiring the ability to oversee financial matters while on the move.

Invoicing and Payments

QuickBooks Online streamlines the invoicing process, allowing users to create and customize professional invoices. It also facilitates online payments, making it convenient for clients to settle invoices promptly. The platform tracks invoice status and sends reminders for overdue payments, improving cash flow management.

Expense Tracking

As a business accounting app, it simplifies expense tracking by enabling users to capture receipts with a mobile device. It categorizes and matches expenses to transactions automatically, reducing the manual effort required for accurate financial reporting. This feature is particularly useful for businesses looking to manage costs efficiently.

Bank Reconciliation

QuickBooks Online syncs with bank accounts, automating the reconciliation process. This ensures that transactions are accurately recorded, reducing the risk of errors and providing a real-time view of the business’s financial position.

Financial Reporting

QuickBooks Online provides users with a comprehensive suite of reporting tools, enabling the generation of a diverse range of financial reports, encompassing profit and loss statements, balance sheets, and cash flow statements. These reports provide valuable insights into business performance and aid in strategic decision-making.

Integration with Third-Party Apps

The platform integrates seamlessly with a wide range of third-party apps, such as payment processors, point-of-sale systems, and e-commerce platforms. This adaptability enables businesses to tailor their accounting solution to their specific needs and integrate it into their existing workflow.

Scalability

QuickBooks Online is scalable, accommodating businesses of different sizes and complexities. Whether you’re a sole proprietor or a growing enterprise, the app can adapt to your evolving accounting requirements.

Security and Compliance

QuickBooks Online prioritizes security, employing robust encryption and data protection measures. It also helps businesses stay compliant with tax regulations by providing tools for accurate tax reporting.

According to Meru Accounting, QuickBooks Online stands out as a top choice for businesses seeking a comprehensive and user-friendly accounting solution. Its features, including cloud-based accessibility, invoicing capabilities, expense tracking, and scalability, make it an invaluable tool for managing finances efficiently. As businesses navigate the digital landscape, having a reliable accounting app like QuickBooks Online is an essential step toward financial success.

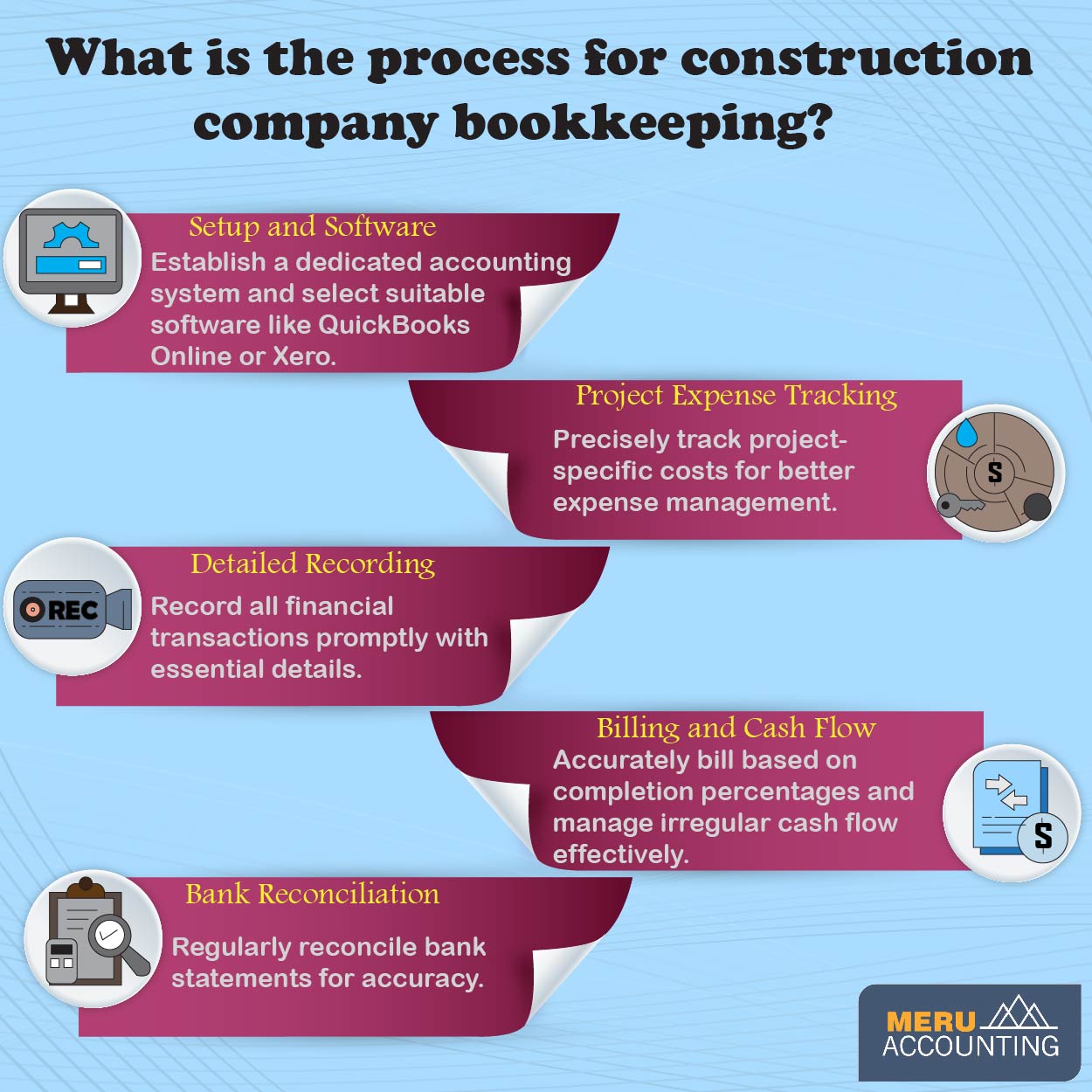

What is the process for Construction Company bookkeeping?

Construction Company bookkeeping is the process of recording and tracking all financial transactions of a construction business. This includes income and expenses, as well as project-specific costs. Whether you’re a small contractor or a large construction firm, effective bookkeeping is essential for tracking expenses, managing budgets, and ensuring compliance with tax regulations.

In this article, we will delve into the process of Construction Company bookkeeping and matters incidental to bookkeeping for contractors.

Road map for Construction Company bookkeeping:

1. Getting Started.

The first step in Construction Company bookkeeping is setting up a dedicated accounting system. This system should include all financial transactions related to your construction projects. It’s crucial to maintain separate accounts for each project to accurately monitor their profitability.

2. Choose bookkeeping software.

There are a number of different bookkeeping software programs available, so it is important to choose one that is right for your business needs. Some popular bookkeeping software programs for construction companies include QuickBooks Online and Xero.

3. Record all financial transactions.

This includes income, expenses and project-specific costs. Be sure to record all transactions in a timely manner and to include all relevant details, such as the date, amount, and description of the transaction.

4. Reconcile your bank statements.

This involves comparing your bank statements to your bookkeeping records to make sure that they match. This is an important step in ensuring that your bookkeeping records are accurate.

5. Generate financial reports.

Once you have recorded all financial transactions and reconciled your bank statements, you can generate financial reports. These reports can be used to track your business performance, make informed business decisions.

Important things to note when it comes to bookkeeping for contractors:

1. Tracking expenses :

Construction contractors face a number of unique bookkeeping challenges. One of the biggest challenges is tracking project-specific costs. Contractors often have multiple projects underway at the same time, and it can be difficult to keep track of all of the costs associated with each project.

2. Billing errors :

Another challenge is billing customers. Contractors typically bill their customers based on a percentage of completion, which can make it difficult to estimate how much to bill for each job.

3. Irregular cash flow :

Contractors often have to deal with irregular cash flow. This is because they may not receive payment from customers until a project is completed. As a result, it is important for contractors to have a good understanding of their cash flow and to make sure that they have enough money to cover their expenses.

Investing in the right accounting software and seeking professional guidance when necessary can streamline your bookkeeping processes. Remember that accurate and organized Construction Company bookkeeping is the foundation upon which you can build a thriving construction business.

Meru Accounting, as a proficient bookkeeping firm, can be a vital asset when it comes to bookkeeping for contactors looking to streamline their financial operations in their business. Our team is well-versed in tracking project-specific expenses, managing payroll for construction workers, and ensuring tax compliance within the construction sector.

Meru Accounting‘s commitment to precision and transparency ensures that your construction company’s financial records are always in excellent hands, giving you the peace of mind to focus on what you do best – building success.

The post Best business accounting app for business. appeared first on Bookkeeping Services UK.